Loan Calculator

🧮 Free Online Loan Calculator – Calculate EMI, Interest & Total Payment Instantly

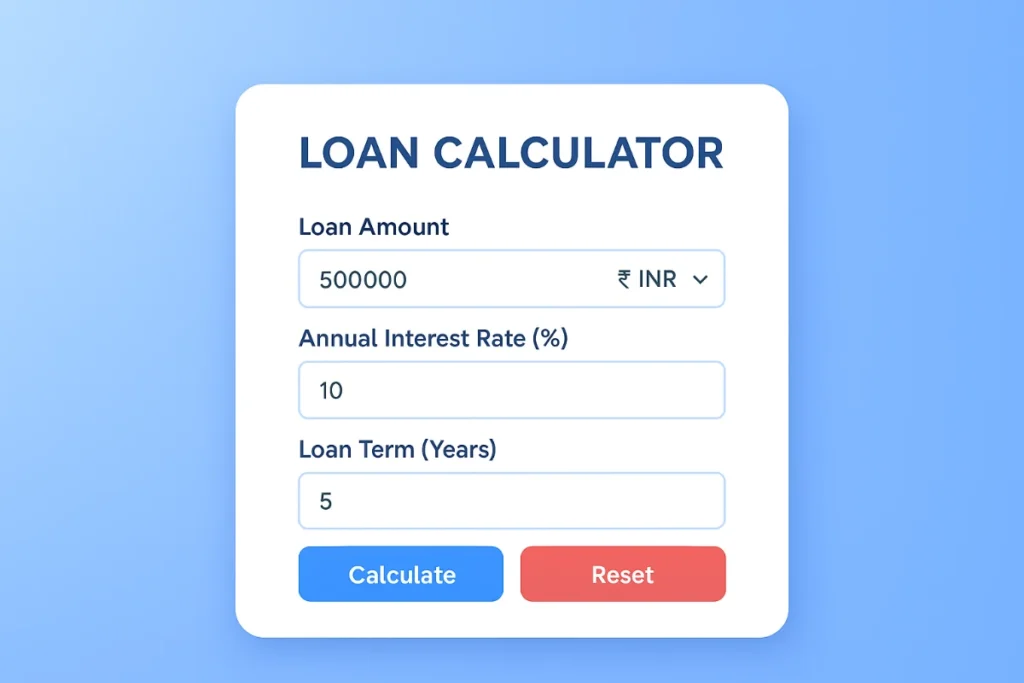

If you’re planning to buy a car, a house, or take a personal loan, knowing your monthly EMI, total interest, and repayment amount in advance is essential. Our Free Online Loan Calculator helps you calculate your loan repayment details instantly — saving you time and financial stress.

Whether you’re comparing banks, loan options, or just exploring your budget, this easy-to-use calculator gives you a clear breakdown of your monthly payments, total interest, and total loan cost in seconds.

💡 What is a Loan Calculator?

A Loan Calculator is a smart online financial tool that allows you to calculate your monthly EMI (Equated Monthly Installment), interest amount, and total payment based on the loan amount, interest rate, and loan term.

This helps you make informed decisions when applying for loans — whether personal, car, education, or home loans.

By entering a few simple details, such as your principal loan amount, annual interest rate, and repayment term in years, you can get a detailed result instantly.

⚙️ How Does the Loan Calculator Work?

Our Loan Calculator Tool is powered by an accurate EMI formula used by most banks and financial institutions.

The formula used is:

EMI = [P × r × (1 + r)ⁿ] / [(1 + r)ⁿ – 1]

Where:

P = Loan Amount (Principal)

r = Monthly Interest Rate (Annual Rate ÷ 12 ÷ 100)

n = Loan Term in Months

Once you hit Calculate, the tool instantly displays:

Your Monthly EMI

Your Total Payment (Principal + Interest)

Your Total Interest Payable

This helps you understand the financial burden before committing to a loan.

🌟 Key Features of the Loan Calculator

Our Loan Calculator is designed with simplicity, accuracy, and user experience in mind. Here’s what makes it stand out:

✅ 1. User-Friendly Interface

You don’t need any technical skills — just enter your loan details, and the calculator gives you the result instantly.

✅ 2. Multi-Currency Support

It supports multiple global currencies including ₹ (INR), $ (USD), € (EUR), £ (GBP), ¥ (JPY), and ₩ (KRW). This makes it ideal for both Indian and international users.

✅ 3. Accurate EMI & Interest Calculation

The calculator uses a precise mathematical formula ensuring that your results match what banks and lenders offer.

✅ 4. Instant Results

No waiting time — the moment you enter your data, you get a complete breakdown of your payments.

✅ 5. Responsive Design

Our tool is mobile-friendly and works perfectly on smartphones, tablets, and desktops.

✅ 6. Reset Option

Quickly clear all inputs with one click using the “Reset” button, so you can recalculate with different loan parameters.

✅ 7. Secure & Free to Use

No sign-up or payment is required. The Loan Calculator is completely free, fast, and 100% secure.

📊 Why Should You Use an Online Loan Calculator?

Using a Loan Calculator before taking a loan is one of the smartest financial decisions you can make. Here’s why:

Budget Planning: It helps you understand your monthly financial commitment and ensures you don’t overstretch your budget.

Loan Comparison: You can compare loan offers from different banks and lenders by adjusting the interest rate and loan term.

Transparency: You’ll know exactly how much interest you’re paying over the loan period.

Quick Decision Making: Get instant results and take better loan-related decisions.

🔗 Related Financial Tools You Might Like

If you love using smart online calculators, here are some more useful tools to explore:

📅 Online Age Calculator – Instantly calculate your exact age in years, months, and days.

💪 Free BMI Calculator Online – Check your Body Mass Index to know your fitness status.

📈 Percentage Calculator of Marks – Easily calculate exam percentages and scores.

🎲 Online Probability Calculator – Find probabilities of any event in seconds.

💰 Smart GST Calculator Online – Quickly compute GST amounts for products and services.

These tools are part of FileHorse’s growing suite of free online calculators designed for students, professionals, and individuals looking to make fast and accurate calculations online.

💼 Benefits of Using Our Loan Calculator

Here’s why thousands of users prefer our Loan Calculator Tool:

No registration required

Works in real-time

Lightweight and fast

100% accurate calculations

Clear and easy-to-understand results

Free for lifetime use

With the combination of simplicity and precision, it’s an excellent tool for personal finance planning, loan management, and budget forecasting.

📉 Example: Loan Calculation Made Simple

Let’s take an example for better understanding:

Loan Amount: ₹5,00,000

Interest Rate: 10% per annum

Loan Term: 5 years

After entering these values, the calculator will show:

Monthly EMI: ₹10,624

Total Payment: ₹6,37,440

Total Interest: ₹1,37,440

This gives you a transparent look at how much you’ll pay and helps you decide whether you can afford this loan comfortably.

🏁 Final Thoughts

A Loan Calculator is not just a tool — it’s your financial assistant. It empowers you to make smarter borrowing decisions by providing transparency on your EMI and total repayment costs.

Before applying for a loan, use this Free Online Loan Calculator to estimate your payments and avoid unexpected surprises later.

For more powerful and free financial tools, check out our complete collection at FileHorse.in, where you’ll find accurate and easy-to-use calculators for all your daily needs.